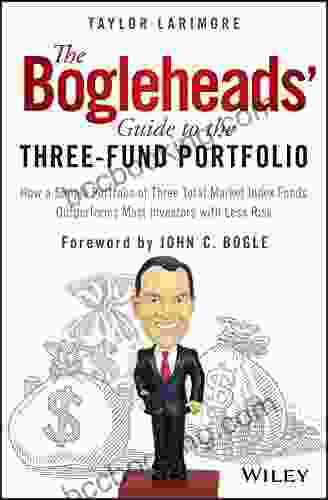

The Bogleheads' Guide to the Three-Fund Portfolio: The Ultimate Guide to Simple, Low-Cost Investing

Are you tired of paying high fees to investment advisors? Are you confused by all the different investment options available? If so, then The Bogleheads' Guide to the Three-Fund Portfolio is the book for you.

4.6 out of 5

| Language | : | English |

| File size | : | 677 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 113 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

This book will teach you everything you need to know about investing, from choosing the right funds to managing your risk. You'll learn how to create a simple, low-cost portfolio that will help you reach your financial goals.

What is the Three-Fund Portfolio?

The Three-Fund Portfolio is a simple, low-cost investment portfolio that was developed by the Bogleheads, a group of investors who follow the principles of John Bogle, the founder of Vanguard. The portfolio consists of three index funds:

- A total stock market index fund

- A total bond market index fund

- A total international stock market index fund

The Three-Fund Portfolio is designed to provide investors with a diversified portfolio that will track the overall stock and bond markets. The portfolio is also very low-cost, with an average expense ratio of just 0.1%. This means that you can keep more of your investment returns.

Why Invest in the Three-Fund Portfolio?

There are many benefits to investing in the Three-Fund Portfolio, including:

- Simplicity: The Three-Fund Portfolio is very simple to manage. You only need to choose three funds and you're done.

- Low cost: The Three-Fund Portfolio is very low-cost, with an average expense ratio of just 0.1%. This means that you can keep more of your investment returns.

- Diversification: The Three-Fund Portfolio is very diversified, which means that it will help you reduce your risk.

- Long-term performance: The Three-Fund Portfolio has a long history of strong performance. Over the past 10 years, the portfolio has returned an average of 10% per year.

How to Get Started with the Three-Fund Portfolio

Getting started with the Three-Fund Portfolio is easy. Here are the steps you need to follow:

- Choose a broker. There are many different brokers that you can choose from. Some of the most popular brokers include Vanguard, Fidelity, and Charles Schwab.

- Open an account. Once you have chosen a broker, you need to open an account. This process typically takes just a few minutes.

- Fund your account. You can fund your account by transferring money from your bank account or by mailing a check.

- Choose your funds. Once you have funded your account, you need to choose the three funds that you want to invest in. The Bogleheads recommend the following funds:

- Vanguard Total Stock Market Index Fund (VTI)

- Vanguard Total Bond Market Index Fund (BND)

- Vanguard Total International Stock Market Index Fund (VXUS)

The Bogleheads' Guide to the Three-Fund Portfolio

The Bogleheads' Guide to the Three-Fund Portfolio is the definitive guide to simple, low-cost investing. This book will teach you everything you need to know about the Three-Fund Portfolio, from choosing the right funds to managing your risk. You'll learn how to create a portfolio that will help you reach your financial goals.

If you are serious about investing, then you need to read The Bogleheads' Guide to the Three-Fund Portfolio. This book will help you make smarter investment decisions and reach your financial goals sooner.

Free Download your copy of The Bogleheads' Guide to the Three-Fund Portfolio today!

4.6 out of 5

| Language | : | English |

| File size | : | 677 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 113 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Stuart Joy

Stuart Joy Laurell K Hamilton

Laurell K Hamilton Kindle Comixology

Kindle Comixology William Hertling

William Hertling Tina Truax

Tina Truax Tinia Montford

Tinia Montford S E Smith

S E Smith Sonia Manzano

Sonia Manzano Suzanne Alderson

Suzanne Alderson Svetlana Boym

Svetlana Boym Sean Smith

Sean Smith Vladimir Poltoratskiy

Vladimir Poltoratskiy Suzanne Anderson

Suzanne Anderson Tom L Beauchamp

Tom L Beauchamp Sonya Lajuan

Sonya Lajuan Harriet Welty Rochefort

Harriet Welty Rochefort Noah Feldman

Noah Feldman Sean Bennett

Sean Bennett Susanna Heli

Susanna Heli Stephen R Jendrysik

Stephen R Jendrysik

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

David MitchellMind the Door, Mad Myths: Unraveling the Misconceptions Surrounding Mental...

David MitchellMind the Door, Mad Myths: Unraveling the Misconceptions Surrounding Mental...

Julio Ramón RibeyroUnveiling the Next Great Migration: Exploring the Future of Human Mobility

Julio Ramón RibeyroUnveiling the Next Great Migration: Exploring the Future of Human Mobility

Clarence BrooksKey Concepts In Victorian Literature: Unveiling the Essence of an Enigmatic...

Clarence BrooksKey Concepts In Victorian Literature: Unveiling the Essence of an Enigmatic... Tyler NelsonFollow ·2.4k

Tyler NelsonFollow ·2.4k Mark TwainFollow ·5.6k

Mark TwainFollow ·5.6k Rodney ParkerFollow ·3k

Rodney ParkerFollow ·3k Oscar BellFollow ·13.8k

Oscar BellFollow ·13.8k Stanley BellFollow ·6.5k

Stanley BellFollow ·6.5k Theo CoxFollow ·19.7k

Theo CoxFollow ·19.7k Jamison CoxFollow ·8.9k

Jamison CoxFollow ·8.9k Harold PowellFollow ·7.1k

Harold PowellFollow ·7.1k

Amir Simmons

Amir SimmonsImmerse Yourself in the Enchanting Realm of Nora Roberts'...

Prepare to be captivated by...

Dan Henderson

Dan HendersonUnleash the Explosive Action of Going Ballistic Combined...

Prepare for an...

Jeffery Bell

Jeffery BellDiscover the Controversial and Captivating "The Anarchist...

In the realm of literature, there are...

Ryan Foster

Ryan FosterUnveiling Lincoln's Eloquence: How His Greatest Speeches...

In the annals of American...

Jaime Mitchell

Jaime MitchellLove Radio Vinny Berry: A Journey of Heartbreak, Healing,...

Vinny Berry's...

4.6 out of 5

| Language | : | English |

| File size | : | 677 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 113 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |