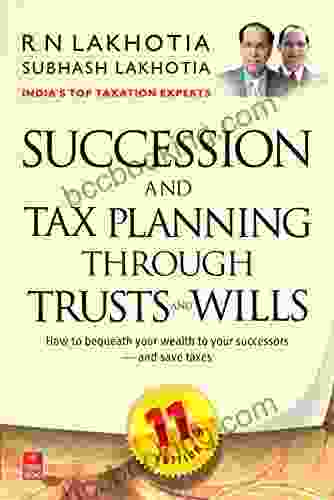

Succession and Tax Planning Through Trusts and Wills: Secure Your Legacy and Minimize Tax Burdens

Planning for the انتقال of your wealth after your passing is crucial to ensure your wishes are respected and your loved ones are financially secure. Trusts and wills are powerful tools that can help you achieve these goals by protecting your assets, minimizing tax burdens, and providing clear instructions for the distribution of your estate.

This comprehensive guide will provide you with an in-depth understanding of succession and tax planning through trusts and wills. You will learn about the different types of trusts and wills, their advantages and disadvantages, and how to tailor them to your specific needs.

Effective succession planning is essential for several reasons:

4.3 out of 5

| Language | : | English |

| File size | : | 634 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 249 pages |

- Preserving your legacy: Trusts and wills allow you to control how your assets are distributed after your death, ensuring your wishes are honored and your legacy is preserved.

- Protecting your loved ones: By creating a trust, you can safeguard your assets from creditors and ensure your family is financially secure.

- Minimizing tax burdens: Trusts and wills can be used to minimize inheritance and estate taxes, reducing the financial burden on your beneficiaries.

A trust is a legal agreement that separates the ownership of assets (the trust corpus) from the control and management of those assets (the trustees). Trusts can be used for a variety of purposes, including:

- Asset protection: Trusts can protect assets from creditors, lawsuits, and other financial risks.

- Estate planning: Trusts can help minimize inheritance and estate taxes by controlling the distribution of assets after your death.

- Special needs planning: Trusts can provide for the care and financial well-being of individuals with special needs.

There are several different types of trusts, each with its own unique advantages and disadvantages. Some common types of trusts include:

- Revocable trusts: These trusts can be modified or terminated during your lifetime.

- Irrevocable trusts: These trusts cannot be modified or terminated once they are created.

- Testamentary trusts: These trusts are created in your will and take effect after your death.

A will is a legal document that specifies how your assets will be distributed after your death. Wills are essential for everyone, regardless of their age or wealth.

Wills should include the following:

- Names of beneficiaries: The people who will inherit your assets.

- Specific bequests: Any specific items or amounts of money you wish to give to specific individuals.

- Executor: The person responsible for carrying out the instructions in your will.

Both trusts and wills can be effective estate planning tools, but they have different advantages and disadvantages. The following table compares the key differences between trusts and wills:

| Feature | Trust | Will | |---|---|---| | Control over assets | During your lifetime and after your death | After your death | | Asset protection | Yes | No | | Tax planning | Yes | Limited | | Flexibility | Can be modified or terminated (revocable trusts) | Cannot be modified or terminated after they are created | | Cost | Typically more expensive than wills | Typically less expensive than trusts |

The best option for you will depend on your individual circumstances and goals. If you need to protect assets, minimize taxes, or provide for special needs, a trust may be a better choice. If you have a simple estate and do not need to protect assets, a will may be sufficient.

Creating and funding trusts and wills is a complex process that requires careful planning and legal advice. The following steps will help you get started:

- Identify your goals: Determine what you want to achieve with your succession plan.

- Choose a qualified professional: Work with an attorney and financial advisor who specialize in estate planning.

- Draft your documents: Your attorney will draft your trust or will based on your goals and instructions.

- Fund your trust: If you are creating a trust, you will need to transfer assets into the trust.

Trusts and wills can be used to minimize inheritance and estate taxes. Some common tax planning strategies include:

- Using trusts to reduce estate taxes: Trusts can help reduce estate taxes by removing assets from your taxable estate.

- Using wills to reduce inheritance taxes: Wills can be used to reduce inheritance taxes by leaving assets to beneficiaries who are exempt from inheritance taxes.

- Planning for charitable gifts: Charitable gifts can reduce both estate and inheritance taxes.

This chapter provides real-world examples of how trusts and wills have been used to effectively plan for succession and minimize tax burdens.

Succession and tax planning through trusts and wills is a critical component of financial planning. By understanding the different types of trusts and wills, their advantages and disadvantages, and how to tailor them to your specific needs, you can protect your assets, minimize tax burdens, and ensure the smooth انتقال of your wealth to your loved ones.

Take the first step towards securing your legacy and protecting your loved ones. Consult with a qualified professional to start planning today.

4.3 out of 5

| Language | : | English |

| File size | : | 634 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 249 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Shel Banks

Shel Banks Tracy Brown

Tracy Brown Trevor Mcbayne

Trevor Mcbayne Sheri Morehouse

Sheri Morehouse Rosanna Ley

Rosanna Ley Tomu Ohmi

Tomu Ohmi Sonja B

Sonja B Walter Isaacson

Walter Isaacson Kitty Moore

Kitty Moore University Press

University Press Sobia Publication

Sobia Publication Lee Harrington

Lee Harrington Stacy Lynn Harp

Stacy Lynn Harp Vanessa Lachey

Vanessa Lachey Sybille Bedford

Sybille Bedford Shaughnessy Haynes

Shaughnessy Haynes Wendy Tait

Wendy Tait Susan Martineau

Susan Martineau Wesley Avila

Wesley Avila Sam Harris

Sam Harris

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Arthur Conan DoyleVogue and The Metropolitan Museum of Art Costume Institute: A Journey Through...

Arthur Conan DoyleVogue and The Metropolitan Museum of Art Costume Institute: A Journey Through...

W. Somerset MaughamCountdown 2979 Days to the Moon: Dive into the Extraordinary Journey of...

W. Somerset MaughamCountdown 2979 Days to the Moon: Dive into the Extraordinary Journey of...

Vincent MitchellExplore the Untamed Wilderness and Captivating History of the Colorado...

Vincent MitchellExplore the Untamed Wilderness and Captivating History of the Colorado...

Colin FosterThe Greatest Hunting Stories Ever Told: A Literary Safari into the Heart of...

Colin FosterThe Greatest Hunting Stories Ever Told: A Literary Safari into the Heart of... Floyd PowellFollow ·9k

Floyd PowellFollow ·9k Harold PowellFollow ·7.1k

Harold PowellFollow ·7.1k Nathaniel PowellFollow ·4.7k

Nathaniel PowellFollow ·4.7k Travis FosterFollow ·19.8k

Travis FosterFollow ·19.8k Edward ReedFollow ·16.9k

Edward ReedFollow ·16.9k Dan BellFollow ·14.5k

Dan BellFollow ·14.5k George R.R. MartinFollow ·17.3k

George R.R. MartinFollow ·17.3k Hamilton BellFollow ·7.3k

Hamilton BellFollow ·7.3k

Amir Simmons

Amir SimmonsImmerse Yourself in the Enchanting Realm of Nora Roberts'...

Prepare to be captivated by...

Dan Henderson

Dan HendersonUnleash the Explosive Action of Going Ballistic Combined...

Prepare for an...

Jeffery Bell

Jeffery BellDiscover the Controversial and Captivating "The Anarchist...

In the realm of literature, there are...

Ryan Foster

Ryan FosterUnveiling Lincoln's Eloquence: How His Greatest Speeches...

In the annals of American...

Jaime Mitchell

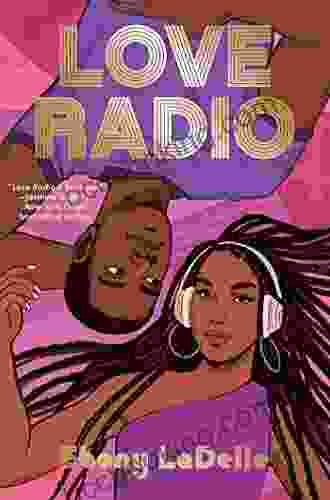

Jaime MitchellLove Radio Vinny Berry: A Journey of Heartbreak, Healing,...

Vinny Berry's...

4.3 out of 5

| Language | : | English |

| File size | : | 634 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 249 pages |